In today’s fast-paced digital world, knowing your bank account balance is more than a convenience—it’s a necessity for smart money management. Whether you are a student managing expenses, a professional keeping track of salary deposits, or a business owner monitoring transactions, checking your ADCB account balance is the first step toward financial control.

Abu Dhabi Commercial Bank (ADCB) is one of the UAE’s leading financial institutions, trusted for its cutting-edge digital banking services and strong customer support. With multiple ways to perform an ADCB account inquiry—from mobile apps to SMS banking—customers enjoy flexibility and security in tracking their funds.

What Does “ADCB Check Balance” Mean?

In banking terms, checking balance refers to verifying the available funds in your account. It ensures you know exactly how much money you can spend, save, or transfer.

- Primary meaning: Verifying available funds in your account.

- Secondary meaning: Maintaining financial equilibrium and control.

The word “check” originates from Old French eschequier, meaning to stop or control.“Balance” comes from the Latin bilanx, referring to a scale with two pans, symbolizing fairness and stability.

In today’s financial context, the term symbolizes responsibility, security, and financial awareness.

Methods to Check ADCB Balance

ADCB provides several convenient options for customers to check their balance. Whether you prefer mobile banking, online portals, or traditional ATMs, there’s a method for everyone.

Mobile Banking

The ADCB Mobile App is one of the fastest and most secure ways to check your balance.

Steps to check your balance:

- Download and install the ADCB Mobile App (iOS/Android).

- Log in using your credentials (username, password, OTP).

- Navigate to the Dashboard.

- View your account balance and recent transactions.

Benefits:

Internet Banking

ADCB Internet Banking is an online banking service that lets ADCB customers manage their accounts anytime, anywhere, without visiting a branch.

- Go to the ADCB website.

- On the login panel (usually on the right side), click “Register” for new users.

- Choose how to register:

Using your ADCB Debit or Credit Card details; or

Using your Customer ID or iPIN, depending on bank offerings. - Fill in necessary details: card number (if using card), PIN, or customer-ID; and your registered mobile number.

- Read and accept the Terms & Conditions.

- Create a new password (which meets the required criteria — usually including letters & numbers).

- You will receive an OTP (One Time Password) on your registered mobile (or by SMS). Use this to validate your registration.

- Submit / Confirm. Once OTP is confirmed, your internet banking account is active.

Key Features of ADCB Internet Banking

Phone Banking

It’s a service provided by Abu Dhabi Commercial Bank (ADCB) in the UAE. Through phone banking, you can perform banking tasks by calling their contact centre rather than going into a branch or using an app.

Below are three concise steps and requirements for each part of ADCB’s phone-banking experience.

Contact Centre

| Step | Action | How to do it (clear) | What you need | Expected result / next action | Quick tip |

|---|---|---|---|---|---|

| 1 | Choose the right number | Pick the number that matches your customer segment (Aspire, Excellency, Privilege, Islamic, Simplylife or Outside UAE). | Know which segment your account belongs to. | Call connects to the correct queue. | Keep the correct number saved in your phone. |

| 2 | Call the Contact Centre | Dial the selected ADCB Contact Centre number (24/7). | Your phone. | You enter the IVR or reach an agent. | Call from your registered mobile for faster verification. |

| 3 | Listen to IVR or request an agent | Follow voice menu prompts to try self-service or press the option to speak to an agent. | Willingness to use keypad or voice commands. | Either complete a simple task via IVR or be placed with an agent. | If unsure, press the option for a live agent. |

| 4 | Authenticate identity | Provide required details (TPIN or other verification questions). | TPIN, account number or recent transaction info, ID details. | Agent verifies your identity and unlocks requested services. | Have recent transaction details ready — it speeds up verification. |

| 5 | Request and confirm the service | Tell the agent what you need (balance, transfer, block card, product info). | Clear instructions and recipient details if transfer. | Agent performs the action and gives a reference/confirmation. | Ask the agent for a reference or confirmation number. |

| 6 | End call and note reference | Confirm next steps and log the reference for your records. | Pen or phone notes app. | You have proof of the interaction and any follow-up timeline. | Save the reference and the agent’s name for follow up. |

IVR (Interactive Voice Response)

| Step | Action | How to do it (clear) | What you need | Expected result / next action | Quick tip |

|---|---|---|---|---|---|

| 1 | Dial the ADCB number | Call the Contact Centre number appropriate for your customer segment. | Phone with keypad. | You hear a recorded welcome and menu. | Use speaker or handset in a quiet place to hear prompts clearly. |

| 2 | Select menu choices | Use keypad digits or say the command when prompted to choose the required service. | Attention to the menu options. | The IVR routes you to the correct self-service flow. | Press 0 or say “Agent” if you need a human operator. |

| 3 | Authenticate (if required) | Enter your TPIN or other requested authentication information via keypad. | TPIN (telephone PIN) or verification answers. | System confirms identity and unlocks service options. | If you don’t remember TPIN, request IVR option to speak to agent. |

| 4 | Complete the chosen task | Follow prompts exactly — confirm amounts, account numbers, etc. | Recipient details for transfers or account numbers for enquiries. | Transaction or enquiry is processed or confirmed. | Listen carefully to confirmation prompts before finalizing. |

| 5 | Receive confirmation | IVR often reads a reference or confirmation number. | Pen to record or phone notes. | You get a recorded confirmation code or SMS (if available). | Record the code; it’s useful if you need dispute help. |

| 6 | Escalate if needed | If IVR cannot help, choose the option to connect to an agent. | Patience to wait in queue. | Agent takes over and handles complex requests. | Use “agent” or the menu option for human support. |

VoicePass (voice authentication)

| Step | Action | How to do it (clear) | What you need | Expected result / next action | Quick tip |

|---|---|---|---|---|---|

| 1 | Confirm eligibility | Ensure you’re an ADCB customer with a registered mobile number and TPIN. | Registered mobile and TPIN. | You can start enrolling for VoicePass. | Enrollment works only from the mobile number registered with the bank. |

| 2 | Start registration | Call the ADCB Contact Centre from your registered mobile and select the VoicePass registration option (or start via ADCB app/telebanking if offered). | Registered mobile, TPIN ready. | System moves you into the VoicePass enrollment flow. | Follow on-screen app prompts if using the mobile app — both routes are valid. |

| 3 | Record voice samples | The system asks you to repeat a short, fixed phrase three times (e.g., “At ADCB, my voice is my password”). Speak in your normal tone in a quiet place. | Quiet environment; clear, natural voice. | Voice samples are recorded and securely stored for matching. | Use a quiet room and avoid throat clearing while recording. |

| 4 | Verification by agent | After recording, the call may transfer to an agent who verifies your identity and completes enrollment. | Patience for the agent verification step. | Enrollment is completed and linked to your account. | Ask the agent to confirm successful enrollment before ending the call. |

| 5 | Using VoicePass to authenticate | On future calls, choose the “Other Banking Services” or VoicePass option; speak the same phrase when prompted. | Your registered mobile and voice. | System matches your live voice to stored sample and grants access if matched. | Speak naturally — don’t whisper or shout; avoid background noise. |

| 6 | If authentication fails | If the voice match fails, select fallback authentication (TPIN, security questions or speak to agent). | Alternate verification details (TPIN, ID info). | Agent or alternative method verifies and completes your request. | If you have repeated failures, re-enroll in a quiet environment with an agent. |

SMS Banking

SMS banking is a service that allows bank customers to perform basic banking tasks using text messages (SMS) via their mobile phones. Instead of using apps or visiting branches, you send predefined text commands (“keywords”) to a short number, and the bank responds by performing actions or giving you information via SMS.

Features of ADCB SMS Banking

WhatsApp Banking

ADCB WhatsApp Banking is a convenient, secure, and user-friendly digital service that allows customers to access essential banking features directly through WhatsApp. With this service, users can make bill payments, place service requests, and easily locate nearby branches or ATMs. It is designed to be simple to use, offering safe and encrypted transactions while supporting multiple languages to cater to diverse customer needs—all through the familiar and accessible WhatsApp platform.

Key Features of WhatsApp Banking

Online Chat

ADCB Online Chat” is a customer support channel offered by Abu Dhabi Commercial Bank that lets users interact with bank agents via text, either through the ADCB website or via their mobile banking app. It’s intended as an alternative to phone or in-person service.

Operational hours are 8 am to 8 pm UAE time.

ADCB MoneyBuddy features

Here are the features of ADCB MoneyBuddy (from Abu Dhabi Commercial Bank), a tool/app for personal finance management.

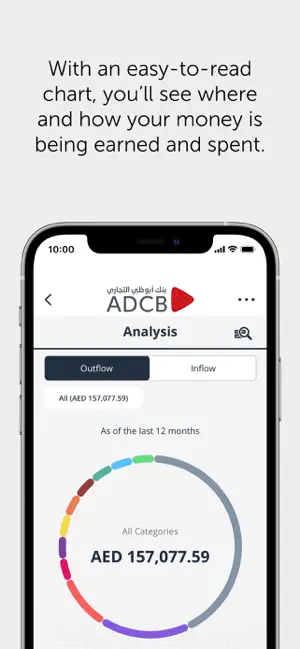

- Analysis

Allows you to review and analyse all your account/card transactions in one place. You can view “Outflow” (spending) vs “Inflow” (income), and tap different colours/categories to see how your money is being spent and earned. - Cash Flow

Helps you understand your patterns of incoming and outgoing funds. You can view these either in detailed tables or via charts, making it easier to see where money is going and coming from over time. - Budget

Lets you monitor your spending against predefined budgets set by ADCB. You also have the option to define your own custom budgets. - Savings

You can set saving goals (whether small or large) and get notifications about your progress. The app notifies you if you’re on track, or warns if you risk deviating from your target. - Calendar

Gives a date-based view of your inflows and outflows. Also shows potential future transactions (based on past patterns) so you can anticipate and plan ahead. - Community

Anonymous comparison of your financial performance with peers. This helps you see how you’re doing compared to others in similar financial situations. - Notifications

Alerts and messages about important financial events. You can receive them via email, SMS, or in the app itself. - What-If?

This is a predictive tool: you can simulate unplanned purchases or changes to see how they would affect your budget, cash flow, savings, and accounts. It shows risk levels (green = no impact, amber = slight negative, red = more serious). - Accounts

A view of all your accounts and cards in one place.

Download now

Now you can download it by Google apps and play store.

Logging in

Option 1 – Use your ADCB Mobile App password.

Option 2 – Request a One-Time Password.

Option 3 – Use biometric authentication (this depends on the handsets).

How to activate

- Enter your Customer ID and your registered mobile number (include country code, e.g.

971...) when prompted. - An activation key / code will be sent to your registered mobile number.

- Enter that activation key in the app to activate MoneyBuddy.

KYC Documents Update

You can easily submit your ID documents online.

At ADCB, we are committed to providing you with secure and seamless banking services while ensuring compliance with regulatory requirements. To meet the latest guidelines issued by the Central Bank of the UAE, it is important that we keep your records accurate and up to date. As part of this process, we kindly request you to update your Know Your Customer (KYC) documents with us.

Keeping your KYC information current helps us serve you better, protect your account, and maintain the highest standards of financial security. The update process is simple, convenient, and designed to take only a few minutes.

How to Update Your KYC Documents with ADCB

Updating your KYC documents is quick and convenient. You can use it in any of the following ways: through the ADCB mobile banking app, ADCB online banking, at an ADCB branch or an ADCB ATM/ATM machine.

Required Documents

- Valid Emirates ID

- Valid Passport

- Valid Residency Visa (for expatriates)

Passport Guidelines

- Ensure all details on the document are clear and easy to read before uploading.

- Crop and align the image so that only the required information is shown.

- Make sure all four edges of the document are visible.

- Upload documents in a straight, front-facing view (not tilted or rotated).

- Each document should be no larger than 2MB in size.

Emirates ID Guidelines

- When uploading, ensure your document details are clearly visible.

- Align and crop the file so it displays only the necessary information.

- Confirm that all four borders of the document are shown.

- Verify that the document is front-facing and upright, not rotated.

- The file size must not be more than 2MB.

Branches Network

In ADCB, the branch network refers to the physical network of bank branches and ATMs spread across the UAE that customers can visit for banking services.

- For details on branch locations, available services, and operating hours, please click here.

- To better serve People of Determination, selected branches have been made fully accessible. In addition, all ADCB branches are equipped with tools and job aids designed to assist People of Determination and other vulnerable groups.

| Emirate | Branch Name(s) | Accessibility | Notes |

|---|---|---|---|

| Abu Dhabi | – Al Hosn Branch – Dalma Mall Branch – Mussafah Branch | People of Determination friendly | Equipped with job aids and tools for vulnerable groups |

| Ajman | – Ajman Branch | People of Determination friendly | Full-service branch |

| Al Ain | – Hazza Bin Zayed Stadium Branch | People of Determination friendly | Located inside Hazza Bin Zayed Stadium complex |

| Dubai | – Al Karama Branch – Arabian Center Branch | People of Determination friendly | Convenient access and extended service hours |

| Fujairah | – Dibba Branch – Fujairah Branch | People of Determination friendly | Serving both city and Dibba community |

| Ras Al Khaimah | – Ras Al Khaimah Branch | People of Determination friendly | Centrally located, easy customer access |

| Sharjah | – Al Buhaira Branch | People of Determination friendly | Strategically located in Buhaira Corniche area |

New Openings & Service Updates

| Effective Date | Update | Location / Branch | Status |

|---|---|---|---|

| October 20, 2025 | Transition into Digital Banking Center – uBank | ADCB Dhaid Mall Branch | Temporarily Closed → uBank Conversion |

| August 02, 2025 | Grand Opening of new branch | ADCB Jumeirah Branch, Triple 777 Centre, Al Wasl Rd, Dubai | Newly Opened |

| August 04, 2025 | Temporarily closed for renovation | ADCB Mall of Emirates Branch | Under Renovation |

| July 26, 2025 | New ATM Service Center opened | Al Nahyan Area – Abu Dhabi | ATM Service Active |

| July 2025 | Transition into Digital Banking Centers – uBank | – ADCB Abu Dhabi Mall Branch – ADCB GASCO Branch – ADCB Khalid Bin Waleed Branch | Temporarily Closed → uBank Conversion |

ATMs Network

ADCB offers one of the largest ATM and Cash Deposit Machine (CDM) networks in the UAE, ensuring customers have quick and convenient access to banking services anytime, anywhere.

For ATM locations, please click here.

New at ADCB ATMs

- Effective June 28, 2025 – Cardless Cash Withdrawal is now available across the entire ADCB ATM network.

- Effective April 13, 2025 – Increased withdrawal limit: All ADCB ATMs and CDMs can now dispense up to AED 30,000 per transaction, up from the previous AED 10,000.

Cardless Cash Withdrawals

As part of our ongoing commitment to enhance digital and ATM services, ADCB has introduced Cardless Cash Withdrawal, giving you secure and convenient access to cash without needing your debit card.

Benefits

- No need to issue cheques or visit a branch for cash payments or withdrawals.

- Withdraw cash securely at any ADCB ATM using just your mobile number.

- Track and control all transactions directly from ADCB Mobile Banking (MIB).

- Cancel a transaction anytime before withdrawal or expiry.

- Update to the latest ADCB Mobile Banking app.

- Log in and go to: Transfers > Cardless Cash Withdrawal > Initiate a Withdrawal.

- Enter withdrawal details and follow on-screen instructions.

- Minimum withdrawal: AED 100 (in multiples of 100).

- Limit: Up to 3 transactions per day, with a daily cap of AED 5,000.

- The recipient must have an active UAE mobile number to receive a withdrawal code (valid for 24 hours).

- Track the request anytime via Transfers > Cardless Cash Withdrawal > Track Withdrawals.

At the ATM

- Visit any ADCB ATM.

- Enter the code received on your registered mobile number.

- Collect your cash instantly.

Step-by-step guides

Go Contactless at ADCB ATMs

- Tap your Debit Card or supported Digital Wallet on the ATM card reader.

- Compatible wallets include Apple Pay, Google Pay, Samsung Pay, Fitbit Pay, Swatch Pay, and Garmin Pay.

What is ADCB uBank?

uBank is ADCB’s innovated “digital banking centre” (sometimes called a Digital Financial Centre) intended to revolutionize how customers interact with their bank. Instead of conventional teller counters and paperwork, uBank provides a hybrid space where customers can:

- Open a new account instantly

- Get or replace debit/credit cards on the spot

- Print cheque leaves

- Receive financial consultations via video assist

- Carry out service requests and minor account changes

In essence, it bridges the gap between purely online banking and traditional branches, giving clients more autonomy and speed while still offering human support when needed. The first uBank was launched in Yas Mall, Abu Dhabi. Additional uBank centres have been rolled out (for example, at City Walk, Dubai) to expand the footprint of this concept. ADCB describes uBank as “future proof,” offering instant services, eco-friendly features, and exclusive offers.

Why uBank? The Rationale & Strategic Vision

1. Merging digital & physical channels

Many customers still value a physical presence, especially for identity verification or complex services. uBank offers a middle ground: a tech-driven environment but with human oversight and physical access points.

2. Operational efficiency

By automating routine tasks—card issuance, cheque printing, form filling—and using video consults and kiosks, uBank can reduce the burden on full branches, freeing up staff to focus on advisory or complex tasks.

3. Customer experience & brand differentiation

It’s a way for ADCB to stand out as an innovator in the UAE banking landscape, appealing especially to tech-savvy customers and younger users. According to industry commentary, the uBank’s model provides a more immersive, modern branch experience with virtual relationship officers and interactive digital signage.

4. Promoting digital adoption

Customers who visit uBank may adopt more of ADCB’s digital services (mobile, internet banking) after experiencing the seamless tech environment. It acts as a “gateway” to full digital banking usage.

Key Features & Capabilities of uBank

| Feature | Description / Benefits |

|---|---|

| Instant Account Opening | New customers can open an ADCB account on the spot via kiosks or guided assistance. |

| On-the-spot Card Issuance / Replacement | Walk in and walk out with a debit or credit card, or replace lost ones immediately. |

| Print Cheque Leaves Immediately | Customers can print up to six cheque leaves per month directly at the uBank kiosk. |

| Video Assist Consultation | Speak with ADCB representatives via video assist for services such as mortgages, investments, or insurance. |

| Service Requests & Minor Updates | Change address, mobile number, supplementary card applications, etc. |

| Digital Signage & Smart Displays | Interactive walls and signage deliver content and guide customers; powered by platforms like PADS4 / IoT analytics. |

| Loyalty / Rewards Integration | uBank is tied into ADCB’s TouchPoints loyalty program; opening an account via uBank can earn extra points. |

| Eco / Paperless Emphasis | The design encourages minimal paper usage and shifting to digital transcripts. |

ADCB uBank: Future. Proof.

ADCB has positioned uBank not just as a digital banking centre for today, but as a future-proof model that can evolve with customer expectations, regulatory frameworks, and rapid technological innovation. The phrase “Future. Proof.” reflects the bank’s vision to build a system that is resilient, adaptable, and ready for what’s next in the financial world.

Trade License Update

“Trade License Update” is a process for business customers of ADCB to keep their company’s licensing information (trade license) current in the bank’s records. This ensures compliance with regulatory requirements (KYC / AML) and ensures ADCB has accurate information about your business.

if your company renews its trade license, or any relevant details (except changes in ownership or name) remain the same, you need to upload the renewed license to ADCB so your business banking remains active and in compliance.

Channels to Update Trade License with ADCB

1. Online / Digital Method (Preferred, if no ownership changes)

- Upload via adcb.com/tl (Trade License Update portal)

- Through ADCB Mobile Banking / ProCash (for business accounts)

- Use the ADCBTL portal (ADCB’s trade license update interface)

📌 Tip: These digital methods allow you to submit the renewed license without physically visiting a branch.

2. Branch / Offline (When changes exist)

If there are changes in the company’s name, ownership, structure, or business activity, you cannot simply upload online. In this case you must:

- Visit an ADCB branch with supporting documents (sale contract, MOA, power of attorney, etc.)

- Or send all required documents via email to ADCB’s business support (for review / validation)